UK Government Bonds or “Gilts” are fundamental – given its role in financing government activity – to the pricing of financial instruments, such as bonds or loans. Gilts are also used to hedge long dated pension liabilities. It is therefore a main determinant in defined benefit pension valuation.

Market expectation of long-term interest rates

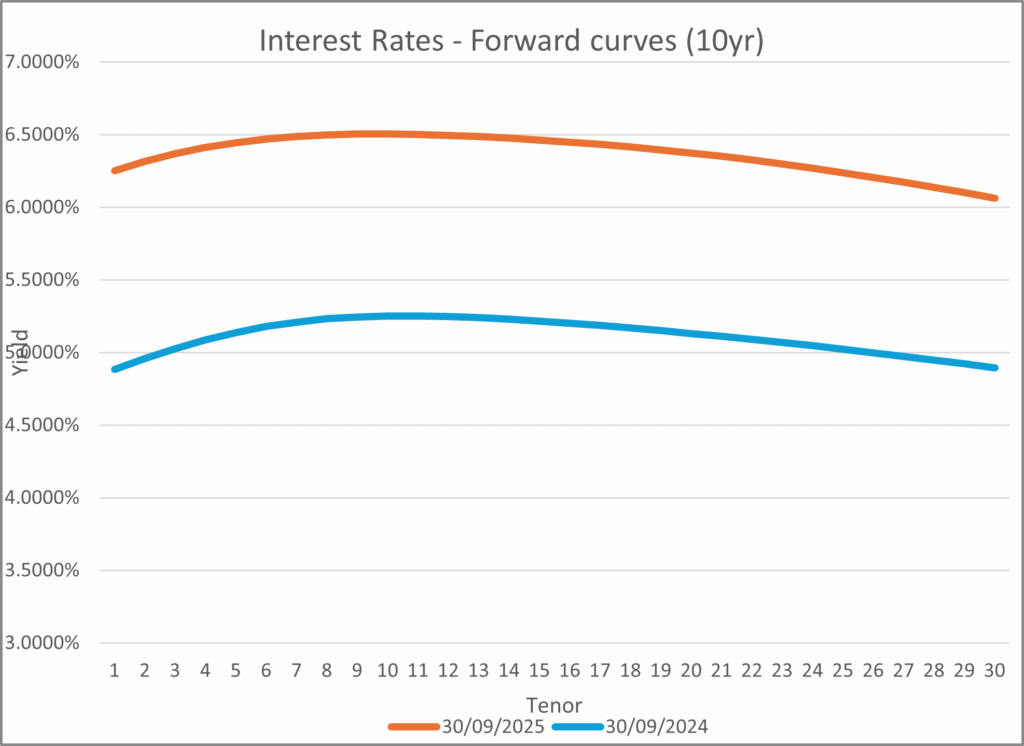

Graph below shows term structure of interest rate (as implied by Gilt prices) on a forward 10-year basis[1]:

Rates have increased markedly over a one-year period from 30/09/2024 to 30/09/2025 – which is clearly shown above. That is due to UK centric factors e.g. UK budget deficits, economic growth, high debt to GDP ratio etc as well as international factors but there is a clear indication that investors are putting a “risk premium” on Gilts vis-à-vis the international peers e.g. other G7 government debt.

Impact on defined benefit pension valuation

The value of defined pension scheme benefit can be simplified to modelling of a forward starting annuity which is dependent on interest rates, inflation and the survival of the member. Those factors determine the value of the annuity and, more importantly, changes in these factors give rise to changes in the value of the annuity. Our modelling has shown that annuity values have dropped in recent periods – corresponding to the increase in interest rates as demonstrated above.

Given that the valuation of defined benefit pensions is at such a low point this introduces opportunities for those managing or acquiring these liabilities. Expert support is available for pricing for potential liability management or exposure purposes, determining capital requirements, or redress determination and settlement.

For Congruent support please see our services page.

[1] Source: Bank of England zero coupon Gilt yields at the end of the relevant quarter. We apply a transformation to derive forward starting 10 year par coupon rates which gives a term structure of rates for tenors from 1 to 30 years.